Marks' Many Things

The Most Important Thing (2011)

THINK, BETTER

First-level thinking

The outlook is good, so the stock will go up

Second-level:

Its good, but everyone thinks it's great, and it's not.

What is the range of likely outcomes? What outcome do I think will occur?

What's the probability I'm right? What does the consensus think?

How does the price comport with the consensus view? And with mine?

Is the price with consensus psychology baked-in too bullish or bearish?

All investors can't beat the market since, collectively, they are the market.

You need an edge in information, analysis, or both.

A good razor: ". . . and who doesn't know that?"

…

CHOOSE INEFFICIENT MARKETS

Efficient Markets Theory

Investors are rational and objective agents with access to equal information.

Investors are open to buying, selling, or shorting every asset.

∴ All available information will be smoothly synthesized into prices and acted on whenever price/value discrepancies arise.

Limitations

Investors are not objective: human beings are driven by emotions.

Investors are not generalists: most professionals are assigned to niches (e.g. bonds or equities) and most investors never sell short.

Efficiency is not black-and-white: it is a matter of degree.

Let theory inform but not dominate your decision (it also says $10 can’t be found on the floor, but we all have)

Inefficient ≡ prone to mistakes that can be taken advantage of.

Inefficiencies are a necessary condition for outperformance.

But they do not guarantee it. For every person who gets a good buy in, someone else sells too cheap (every game of poker has a “fish”)

Efficiency should be presumed true until proven false.

Inefficiencies that exist today might not be around tomorrow.

Signs of an inefficient market:

Incorrect Prices: Prices deviate from intrinsic values due to imperfect information and analysis.

Wonky Returns: Risk-adjusted returns are out of line other asset classes.

Superstar Investors: Some players consistently outperform due to (a) significant misvaluations and (b) differences in skill, insight, and information.

Some stress-test questions:

If the return far outweighs the risk, am I overlooking some hidden risk?

Why would the seller give me the asset at a price where I make mega money?

Do I really know more about the asset than the seller does?

If it’s so good, why hasn’t someone else snapped it up?

…

KNOW THE VALUE

Methods of profit

Rise in intrinsic value (growth investing)

Active management (requires hard work & expertise)

Leverage (amplifies losses too)

Selling higher than intrinsic value (requires a “bigger idiot”)

Buying lower than intrinsic value (Marks Approved)

These all rely on an accurate assessment of value—it gives you the courage to go against the crowd to buy, sell, or hold.

…

UNDERSTAND RISK

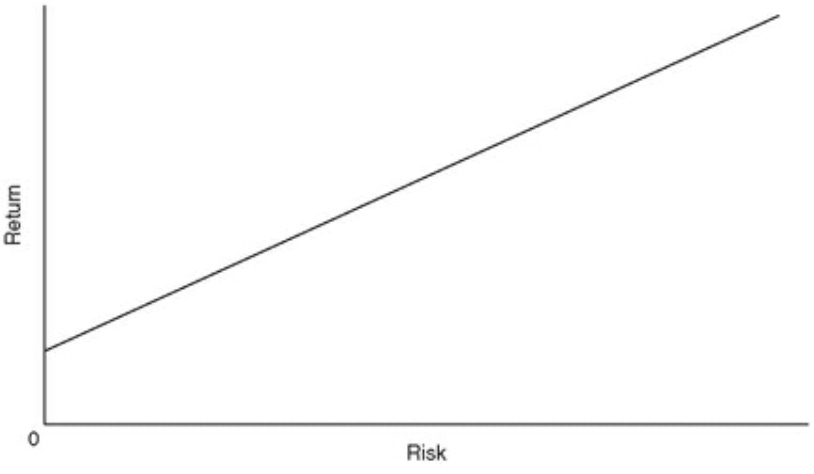

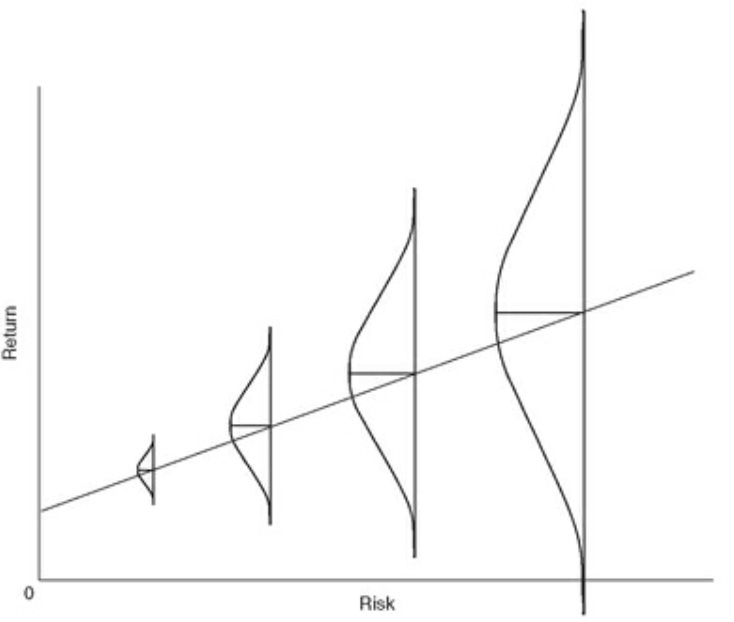

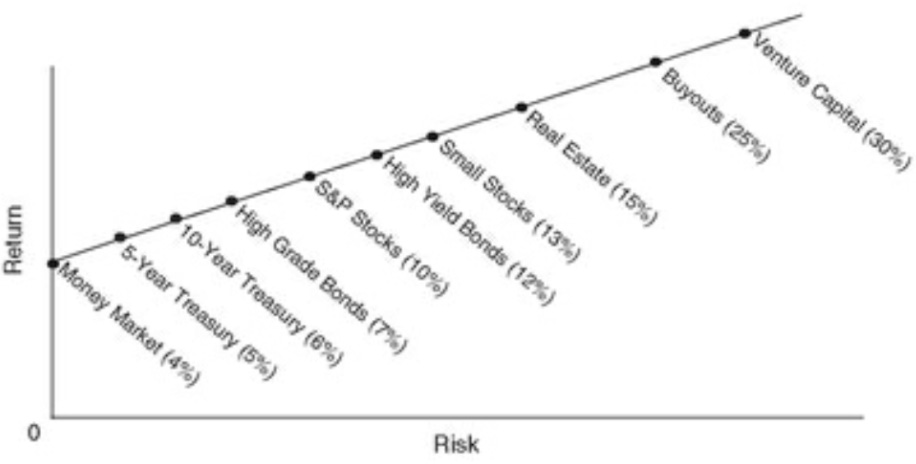

If riskier investments reliably produced higher returns, they would not be riskier. They have to offer the prospect of higher returns

Risk ≠ volatility

Risk is the likelihood of losing money. It is the uncertainty about which outcome will occur and the possibility of loss when unfavorable ones do.

Most visualize risk as the former graph when it should be the latter.

Risk can't be measured, quantified, or observed.

Risk exists only in the future; there is no ambiguity when viewing the past.

A 99% success rate strategy can fail while a 1% one can succeed. You cannot tell if someone is right for the wrong reasons without a large number of trials.

Measuring risk is an art based on a) the stability and reliability of value and b) the relationship between price and value.

"Only when the tide goes out do we see who is swimming naked"

Sharpe Ratio

Measures portfolio excess return above short-term T-bills.

Useful for public market securities that trade and price often.

For assets without market prices, subjective risk adjustment is necessary.

Other mistakes

Expecting the future to resemble the past (induction), thus underestimating tail-end events. Worst case scenarios are often worse.

Overestimating your ability to gauge risk and understand new financial mechanisms, particularly in bullish times.

Assuming risk (e.g. 2% mortgage default) is constant. The six-foot man drowned crossing a river averaging five-feet deep. Risk is lumpy.

Viewing risk primarily as a way to make money (return reaching)

Additional IM Risks

Benchmark — IMs mitigate this by emulating the index.

Underperformance — In turbulent times, disciplined investors may not take enough risk to keep up (e.g. Buffett in 1999).

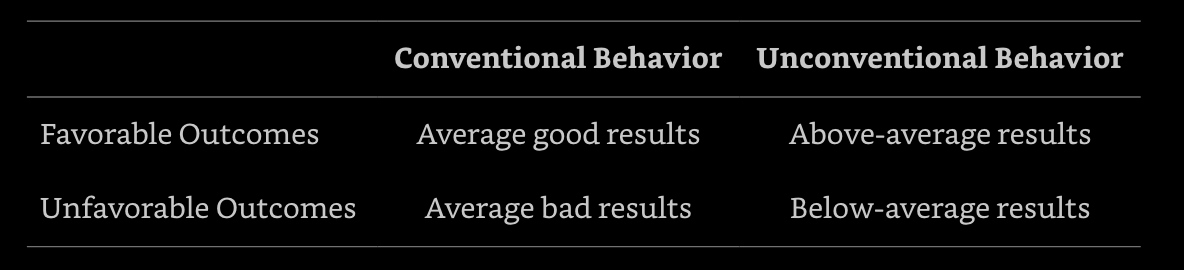

Unconventionality — IMs may prefer average results, even if it means absolute losses, rather than risk deviating from consensus.

…

RECOGNIZE RISK

There are few things as risky as the widespread belief that there's no risk

The risk of economic cycles has been eased by central banks.

Risk has been “tranched out” to the investors best able to bear it.

Risk can be hedged through long/short, derivatives, etc.

Traditional valuation norms (e.g. P/E ratios and cap rates) no longer hold

Leverage has become less risky because rates and terms are much friendlier.

LBOs are safe because only companies fundamentally stronger are bought.

Math, modeling, tech, etc. make markets better understood and thus less risky.

Market structures cannot eliminate risk.

Risk will be low only if investors behave prudently (they won’t)

"I wouldn't buy it at any price, it's too risky" is also flawed for this reason.

The Risk Paradox

Rising fear and risk aversion ⊃ wider risk premiums (and thus less risk).

Investors incorrectly see quality (instead of price) as determining risk.

…

CONTROL RISK

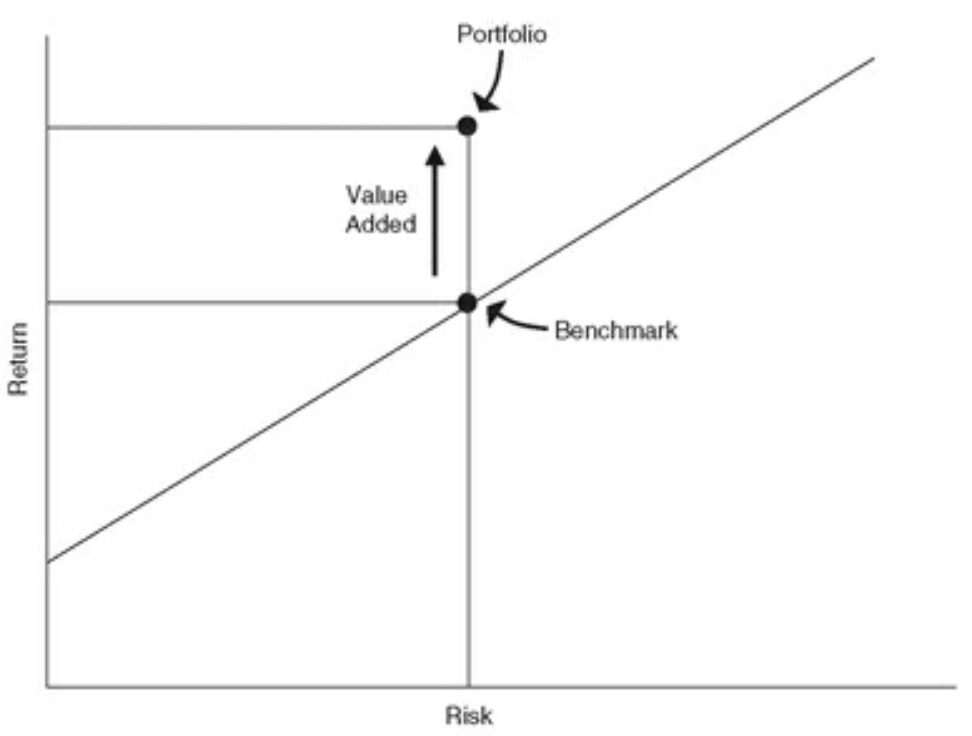

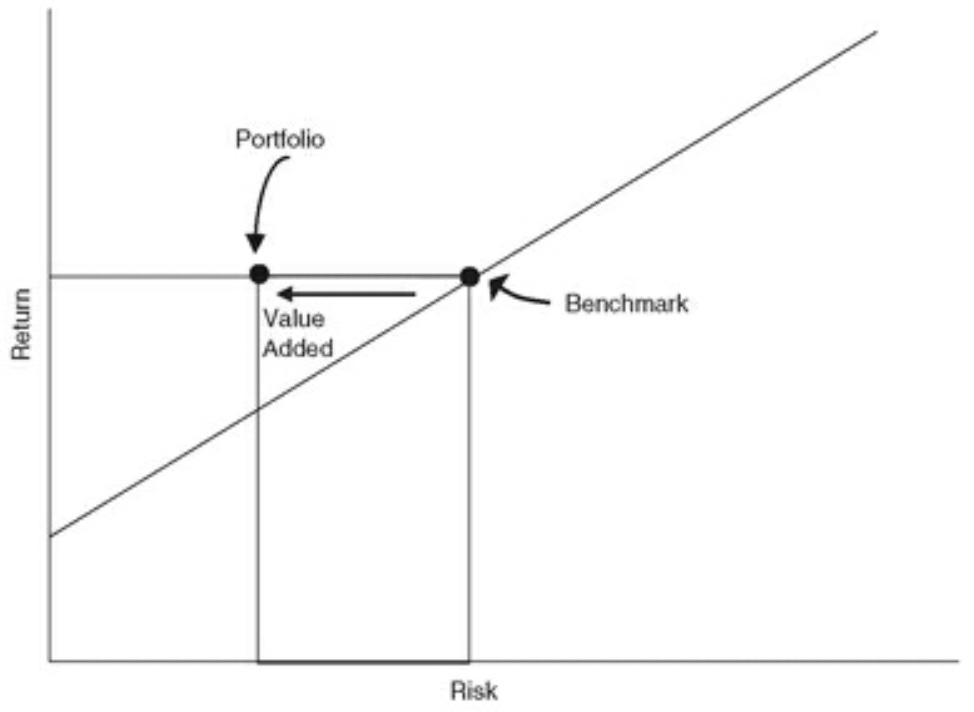

Most understand exploiting inefficiencies as same risk + more reward

. . . but it can also mean less risk + same reward

Risk control vs risk avoidance

Visualize control as carrying fire insurance, even without a fire.

But you can’t run a business—or do anything—on worst-case basis.

Risk control means loss avoidance. Risk avoidance means return avoidance.

Taking on risk for profit (e.g. life insurance)

We know everyone will die. Risks are analyzable (health reports) and diversifiable (age, gender, occupation, location).

So we set premiums based on averages. In inefficient markets, we can profit by assuming a death at 80 for someone likely to die at 70.

Tiers of brainpower

Risk Retards only care about chance for return.

Bumbling Brainlets gain some insight and care about risk too:

They only take on risk when reward is more than adequate (correct).

They think diversification means buying many different things (incorrect).

Savvy Smarties understand correlation:

They know individual investments with the same absolute risk can form portfolios with different total risks.

They know diversification only works if holdings respond differently to market stimuli.

…

CONQUER EMOTIONS

Excess

Greed makes you grab when you shouldn't.

Fear makes you let go when you shouldn't.

Suspension of disbelief

Some fundamental limiter is no longer valid (and thus historic notions for fair value no longer matter).

"Extreme brevity of the financial memory" - John Galbraith.

“Free lunch”

Impressive returns attract unquestioning devotion. Few question whether it can exist or why it should be available to them.

“Nothing is easier than self-deceit. For what each man wishes, that he also believes to be true.” - Demosthenes.

Envy

The true form of FOMO.

A client earned 16% a year between 1994 and 1999 but as upset since peers averaged 23%. But then 2001 happened and they were happy with 3% since others suffered losses. This makes no fucking sense.

Ego

Incorrect, even imprudent, decisions take on more risk typically provides the best returns in good times (and most times are good times).

The best returners get super slobber. Thoughtful investors get none.

Building a ski resort in Miami isn’t a good idea, even if a freak blizzard occurs. Coin flippers need to pour one out for luck.

Capitulation

The stocks you rejected are making money for others, the ones you chose to buy are lower every day, and concepts you dismissed as unsafe or unwise are described daily delivering for others. Will you give in?

We are harmed by excess emotions in three ways:

1. Succumbing to them.

2. Unknowingly participating in markets distorted by others’ succumbing.

3. Failing to take advantage of distorted markets.

…

EMBRACE THE CYCLE

Rule #1: Just about everything is cyclical.

Nothing goes in one direction forever. Few things go to zero.

Occasionally, an up- or down-leg goes on for a long time or to a great extreme, and people think “this time it’s different.” It’s not.

Success carries the seeds of failure, and failure the seeds of success; the potential energy of the pendulum is its own undoing. Very Daoist.

Rule #2: Great opportunities come when others forget Rule #1.

Three stages of a bull market.

1. A few forward-thinking people begin to believe things will get better.

2. Most investors realize improvement is taking place.

3. Everyone concludes things will get better forever.

“What the wise man does in the beginning, the fool does in the end.”

The Credit Crisis

Small economic fluctuations cause large changes in credit availability ⇒

Period of prosperity where capital providers thrive. Scarce bad news means the perceived risks in lending and investing seem to shrink ⇒

Providers more capital with lower demanded returns (rates) and credit standards. "The worst loans are made in the best of times" ⇒

Shitty borrowers and projects are financed and shit goes south ⇒

Lenders are discouraged. Risk aversion, rates, and standards rise ⇒

Companies are capital-starved. Borrowers default and go bankrupt ⇒

Shit goes further south. Look at any crisis, and you will probably find a lender.

Exacerbating factors.

Innovative Investments: tunnel-vision on potential gains of new technology.

Hidden Correlations: portfolio items move together despite “diversification”

Expectation overcorrection: love becomes hate when the reality check cashes.

…

CONTRARIANISM

If "everyone" likes it:

It likely has been performing well, so many believe it will continue to do so.

Outstanding past performance often means future performance will be subpar.

Contrarianism logically follows

High prices reflect high expectations, leaving little room for further gain.

There's significant risk that prices will fall if the crowd changes its mind.

Visualize the market as a scale. If everyone is on the left, the right can only get heavier.

But it has limitations

Market excesses are not always present.

Overpriced does not mean a downturn is imminent. Being too far ahead of your time is indistinguishable from being wrong.

Contrarianism can become herd behavior if everyone believes it.

Actions should be based on a clear understanding of why the crowd is wrong, not just because they are opposite to the crowd's actions.

"Nobody goes to that restaurant anymore, it's too crowded." - Yogi Berra

…

BARGAIN HUNTING

Setting up camp

Be patient—you’ll do better waiting than chasing

Never “reach for return.” If you are accessing the same return as market conditions worsen, ask yourself if you are bearing more risk than you know.

Identifying a bargain

Highly unpopular. No one wants to own them.

Falling prices (brainlets see this as worrisome).

A objective defect (e.g. weakness in asset class or over-levered balance sheet)

A defect based on irrationality or incomplete understanding.

Select from the list of things sellers are motivated to sell rather than start with a fixed notion as to what you want to own.

Trimming the fat

"Investment is the discipline of relative selection.”

Rule out investments with risks you are not comfortable with (e.g. obsolescence risk in fast-moving tech)

Focus on those with the best upside-to-downside ratio.

When you’re in a shitty environment, you can:

Invest as if low returns aren’t true (stupid)

Invest for acceptable relative returns

Invest anyhow (Bogle approved).

Hold cash (painful)

Concentrate in special niches and people (Marks approved)

…

KNOW WHAT YOU DON’T KNOW

Forecasts have very little value

Most of the time, people predict a future that is a lot like the recent past.

Most of the time, the future largely is a rerun of the recent past.

So most forecasts are accurate . . . BUT these are baked-in and worthless.

When the future differs significantly from the past, forecasts are of great value—and least likely to be correct

Don’t be a Smart Dipshit

Smart Dipshits think knowledge of economies, rates, and stocks are essential.

They’re confident it can be achieved and they know they can do it.

They’re aware lots of dipshits exist but assume they’re among the smart ones.

They make directional bets, concentrate positions, lever to the tits, and count on future growth.

Be an Unabashed Idiot

Unabashed idiots know they can’t know the future and don’t have to.

They try to do the best job possible in the absence of that knowledge.

They diversify, hedge, lever less, emphasize value today, and stay high in the capital structure.

The Dipshits did better leading up to the GFC, but the Idiots took a smaller hit and had the dry powder to profit from it.

"It ain’t what you don't know that gets you into trouble. It's what you know for sure that just ain't so" - Mark Twain

…

KNOW WHAT YOU SHOULD

While we don’t know where we’re going, we ought to know where we are.

The Poor Man’s Guide to Market Analysis

…

STAY DEFENSIVE

Not losing is winning

Tennis is a winner's game for pros, you win by making shots that the opponent can’t return. That’s why unforced errors is a stat.

But investing (and amateur tennis) is a loser's game.

"If we avoid the losers, the winners take care of themselves"

Method 1: Avoidance of losers

Due diligence and high standards

Low price (also the best source of margin for error)

Method 2: Avoidance of losing years

No exposure to crash meltdowns

Diversification and limits on risk

"The cautious seldom err or write great poetry"

In order for something to materially help your return if it succeeds, you have to do enough so that it can materially hurt you if it fails.

Investing defensively means fewer home runs but also fewer strikeouts.

The performance of investors who add value is asymmetrical

Marks aims to do as good in good times and not as bad in bad times.

You can calculate the “skill factor” α using Υ = α + βχ, where β measures relative sensitivity to market movements (>1 is more volatile and <1 is less).

Risk-adjusted return is the best metric, but since risk other than volatility can’t be quantified, it should be more art than science.

…

SOME MANTRAS FOR THE ROAD

Always ask yourself, “and who doesn't know that?"

Efficiency should be presumed true until proven false.

Risk is the likelihood of losing money. Visualize risk-return with normal curves.

Risk is lumpy. The six-foot man drowned in a river that averaged five feet deep.

Price, not quality, determines risk. Don’t buy good things, buy things well.

There are few things as risky as the widespread belief that there's no risk.

Risky behavior leads to the best returns in good times (and most times are good).

Risk control leads to loss avoidance. Risk avoidance leads to return avoidance.

Everything is cyclical. The potential energy of the pendulum is its own undoing.

Actions should be based on a clear understanding of why the crowd is wrong.

Aim to do as good in good times and not as bad in bad times.

Pick something sellers are motivated to sell instead of one you want to buy.

Concentrating in special niches and special people is the best use of your effort.