Bogle's Index Pitch

The Little Book of Common Sense Investing (2017)

ULTRA-DENSE THESIS: The market is zero-sum, so diversifying while minimizing taxes and fees (investing in low-cost index funds) is the best way to capitalize on growth in fundamentals.

…

ALLEGORY OF THE GOTROCKS

The Gotrocks family collectively owns the entire stock market, benefiting fully from dividends and capital gains, growing wealth as the market grows.

They hire Helpers (brokers, advisors) to try to outperform the market.

Helpers charge fees and promote frequent trading, leading to more fees and capital gains taxes.

This diminishes the family's net returns as a significant portion of gains goes to the Helpers instead of increasing their wealth.

…

MARKET IS ZERO-SUM

Long-term market growth is driven by company growth, whereas market fluctuations ("animal spirits") will revert to the mean.

The market is a voting machine in the short-term (speculation).

This is the expectations market of speculation

Prices influenced by investor sentiment, not fundamental metrics like sales margins or profits.

The market is a weighing machine in the long term (investing)

This is the real market of investing

Real companies spend money to create and sell products/services.

We should focus on the long-term of investing

…

FUCK MUTUAL FUNDS

Costs and turnover make the market a loser’s game

Transaction costs but also legal, accounting, capital gains, advertising, operating, etc.

Portfolio turnover adds hidden costs (~1% a year); actively managed funds have about 80% turnover, adding brokerage commissions, bid-ask spreads, and market impact costs.

Tax-inefficient due to higher turnover (distribution of short-term capital gains vs. long-term)

Mutual fund information often ignores the impact of inflation

Mutual Funds have poor returns

Actively managed funds often reduce dividend income, which contributed an average 4.2% to the market’s 10% annual return (1926-2016).

Fund managers report time-weighted returns, reflecting asset value changes, reinvested dividends, and capital gains distributions.

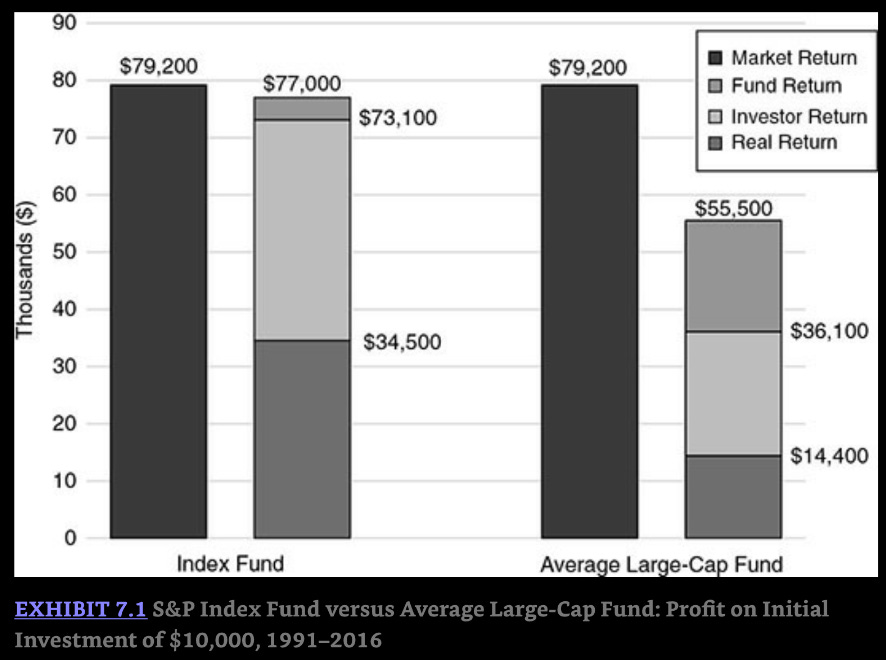

Average mutual fund return (1991-2016): 7.8% annually.

Average fund investor earns 6.3% due to poor timing.

Index fund investors earn closer to actual index returns (8.8%)

…

A TALE OF TWO FUNDS

Magellan Fund

One of 74 surviving (of 355 total) active funds that outperformed S&P.

Most large gain realized earlier. Excess cash influx and outflow (forced buying and selling) caused them to trail the index over time.

Paul Samuelson: "Suppose it was demonstrated that one out of twenty alcoholics could learn to become a moderate social drinker. The experienced clinician would answer, 'Even if true, act as if it were false, for you will never identify that one in twenty, and in the attempt, five in twenty will be ruined.'"

Merrill Focus Twenty:

…

INDEX FUNDS

Have lower costs and consume less of dividend income, meaning higher yields.

Five Paradigms of Total Index Funds (TIFs)

Low Cost

Simplicity

Diversification

Long-Term Focus

Tax-Efficient

Tax Paradox: efficient at managing capital gains but inefficient at distributing dividend income.

Less frequent trading means fewer capital gains taxes. Can be deferred or avoided them entirely if the shares are held indefinitely or bequeathed.

Nearly all dividends from low-cost index funds flow directly to shareholders.

Pick the cheapest.

Expense Ratios: High-cost funds remain high-cost while low-cost funds remain low-cost. Pick the cheapest.

Sales Charges: Sales loads persist and drag returns, and load funds rarely become no-load funds. Pick the cheapest.

Turnover Costs: Rule of thumb: turnover costs = 1% of the turnover rate. Pick the cheapest.

Performance by Cost Quartile: Higher costs correlate with lower returns and increased risk. Pick the cheapest.

…

ETFS AND SMART ETFS

Exchange-Traded Funds

Spider (SPDR) and similar ETFs are most often used by short-term investors.

ETF dollar volume trading often makes up 40% plus of all U.S. market trading.

ETFs have strayed from the buy-and-hold, diversification, and low-cost principles of TIFs.

Broad-market ETFs are the only instance where they can replicate and perhaps improve on the five paradigms, but only when bought and held for the long term.

Smart (or Strategic) Beta ETFs:

Smart beta managers create active strategies while claiming to be indexes.

These ETFs weigh holdings based on “factors” rather than market cap, such as value, momentum, size, corporate revenues, cash flows, profits, etc.

The correlation for these funds with the market (and thus, TIFs) is very high, resulting in higher costs for marginally different results.

…

BONDS

Change "Why should I own bonds?" to "How much should I allocate?"

Bonds have outpaced stocks in 42 years since 1900.

Bonds have outpaced stocks in 29 of 112 five-year periods.

Bonds have outpaced stocks in 13 of 103 fifteen-year periods.

Consider bond indexes that mix investment-grade bonds and government bonds.

For 1:1 ratio of investment and government, a 3:1 ratio of total bond market index fund and investment-grade index is needed.

Rules of index selection are the same as for equities.

…

ASSET ALLOCATION

Stocks and Bonds

A 1986 study found asset allocation accounted for 94% of differences in total returns achieved by institutionally-managed pension funds.

Graham's division: 50/50

Graham had also never experienced a year in which the interest rate on bonds exceeded the dividend rate on stocks.

In 1949, stock yields were 6.9% and bond yields were 1.9%.

In 2017, stock yields are 2% and bond yields are 3.1%.

Bogle’s Recommendation:

80:20 for younger investors (60:40 if retired).

70:30 for older investors (50:50 if retired).

Retirement Investing

Be more conservative as you age.

Uncertain allocation between foreign and U.S. market.

Include Social Security as a bond-like asset: you should lower bond contribution its expected value.

Target-Date Funds (TDF):

Hold diversified portfolios of stocks and bonds that gradually become more conservative as it reaches a target date, usually when the investor expects to retire.

Should look under the hood if you decide on it.

Defined Contribution (DC) Plans:

Employer plan allowing you to defer income directly out of your pay into your retirement account

Most common is 401(k): pretax contributions with potential employer match.

Your investment grows tax-deferred until withdrawal. Often includes provisions for loans and early withdrawals during financial hardship.

Other plans: 403(b) for nonprofits, 457 for certain nonprofits and government employees, Thrift Savings Plan (TSP) for federal employees.

Traditional IRAs:

Available to any wage earner.

Tax-deductible contributions grow tax-deferred until withdrawal.

Maximum annual contribution is usually $5,500.

SEP IRAs:

Designed for self-employed individuals and small-business owners.

Tax treatment similar to traditional IRAs but with higher maximum contribution limits.

Roth IRAs:

No tax deduction for contributions (fully taxed), but withdrawals upon retirement are entirely tax-free, including accumulated gains.

Often better for new investors, but converting from traditional IRAs may incur substantial taxes.

…

OTHER TIDBITS

You cannot time or beat the market. Focus on time in the market.

When Benjamin Graham was asked if an investor should be content with market-returns, his answer was “Yes.”

He foresaw a period of lower return (4-6%) in the future (2017-2027) due to reversion to the mean of 10% annual return. Lower dividends and high valuations were main contributors.